Gemini Sea Foods to raise Tk128cr through 2.14cr right shares

Right shares will be issued at a ratio of two shares for every existing share (2R:1), priced at Tk60 each

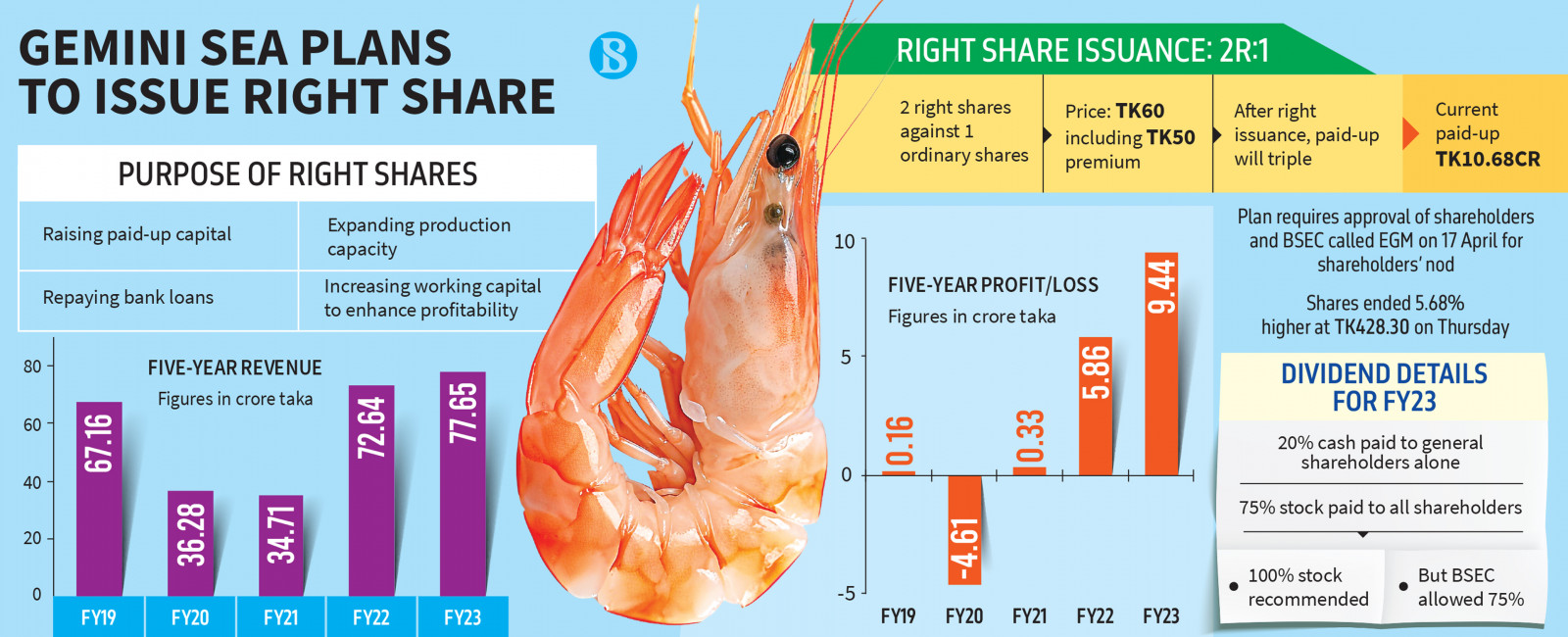

Gemini Sea Foods, a prominent frozen shrimp and fish exporter in the nation, has opted to issue more than 2.13 crore right shares to raise Tk128 crore to bolster its paid-up capital, settle outstanding bank loans, and facilitate business expansion.

The shrimp exporter prepared a plan to issue right shares at a ratio of two shares for every existing share (2R:1), priced at Tk60 each, including a premium of Tk50 per share, according to the minutes of its board of directors meeting, held on 22 February.

According to the company, the implementation of the proposed plan — subject to approval from shareholders and the Bangladesh Securities and Exchange Commission (BSEC) — will result in an addition of 2,13,68,222 new shares to the existing 1,06,84,111 shares. Consequently, the company's paid-up capital will triple to Tk32 crore from the existing Tk10.68 crore.

Right shares refer to new shares offered to the existing shareholders of a publicly listed company in proportion to their current holdings.

In the 2022-23 fiscal year, the company had raised its paid-up capital to Tk10.68 by issuing a 75% stock dividend. A year ago, its paid-up capital was Tk6.10 crore.

AFM Nazrul Islam, company secretary of Gemini Sea Foods, told TBS, "The board of the company has decided to increase paid-up capital through the right offer. The company will use the funds from the right offer to expand production capacity and repay bank loans."

In December 2021, the BSEC instructed the listed companies to maintain Tk30 crore paid-up by next year. To comply with the regulator's instructions, Gemini Sea Foods in FY23 decided to pay a 100% stock dividend to increase its paid-up capital.

Considering Gemini's financial health, the BSEC had allowed it to pay a 75% stock dividend, which had already been paid to its shareholders.

A stock dividend is a payment to shareholders in the form of additional shares in the company.

A stock dividend might be distributed by a company to compensate its investors, especially when it lacks available cash or chooses to reserve it for alternative purposes.

To get shareholders' nod, the company called an extraordinary general meeting (EGM) on 17 April. The EGM will be held under a hybrid system through physical and digital platforms.

The record date for the EGM is fixed on 18 March, but the company said, another record date for entitlement to the proposed right shares will be announced later on after obtaining approval from the BSEC.

Gemini background

Gemini Sea Foods, a pioneer in exporting certified organic shrimp to EU retailers, processes, packages, and exports quality frozen raw shrimp, cooked shrimp, and whitefish.

Listed on the Dhaka Stock Exchange in 1985, the company exports its products to the US, the UK, Germany, Denmark, the Netherlands, Belgium and Russia.

The shrimp exporter witnessed a drastic fall in revenue and profit when the pandemic struck in 2020. However, it made a comeback and in 2021-22, it reported a more than double revenue and profit to Tk72.64 crore and Tk5.86 crore, respectively. In FY23, its revenue further increased to Tk77.65 crore and net profit to Tk9.44 crore.

However, the BSEC formed an enquiry committee in August 2023 to investigate the financial disclosures of Gemini Sea Foods following reports of "inflated revenue figures" for the first nine months of FY23.

In March last year, Gemini Sea had inked a deal with a German-based leading frozen food company Lenk Frozen Foods (Asia) Co. Limited (LENK) to sell processed shrimps.

Under this agreement, Gemini Sea Foods will process the raw materials (Shrimp) sourced by LENK to make them exportable to the specified purchase order of LENK with 100% advance payment.

Gemini Sea Foods will earn more than Tk50 crore in revenue annually under the agreement, according to the company.

According to the DSE, at the beginning of 2023, the share price of Gemini Sea Foods began to increase abnormally, and the share price increased to Tk934.4 each on 7 May.

The share price declined to Tk316 each on 9 January this year. Now the share price of the company is on the rise. On 22 February, its share price closed at Tk428.30 each, a 5.62% or Tk22.8 increase per share.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel