Why RMG nearshoring never posed a real threat to Bangladeshi manufacturers

Unit costs remain significantly lower when sourcing from Bangladesh, which is why creating nearshoring options is not a direct threat to Bangladesh’s apparel manufacturers when it comes to prices

According to the sixth edition of McKinsey & Company's Apparel Chief Purchasing Officer (CPO) Survey published in 2021, 71% percent of apparel and fashion brands were planning to raise their nearshoring share by 2025.

The report, titled 'Revamping fashion sourcing: Speed and flexibility to the fore' was taken so seriously across the globe that it gave birth to a series of analyses and op-eds speculating what Asian RMG manufacturers' new strategies should be to ensure their survival in the new reality.

Even in 2024, stories continue to surface citing the McKinsey report, on how the apparel companies are looking to change their sourcing-country mix, mainly focusing on nearshoring.

The projection, or the perceived change, was influenced by supply-chain disruptions in the wake up of Covid-19, which were "here to stay," according to the report, necessitating "speed and flexibility."

This appears to be the latest in a series of enthusiastic reports published by McKinsey. Earlier in 2018, the global management consulting firm launched another report optimistically titled, 'Is apparel manufacturing coming home?'

Both the reports mention that the majority of the interviewed CPOs said nearshoring and automation were their top priorities.

At the beginning of 2024, it is only appropriate to take a deeper look into the matter, as to how much of that target was actually achieved, and if that ever posed a threat to Bangladesh's RMG as sourcing from the nearshore would automatically mean the decline of RMG exports from Asian countries.

As it turns out, the apparel manufacturing never quite "came home" or even near home, seen from a Global North perspective. At least, the current trends do not seem to support the fulfilment of the nearshoring goals anytime soon.

Although nearshoring is attractive for big brands due to shorter lead times and reduced risks emanating from 'skyrocketing transportation costs and potential shutdowns,' limited raw-material supply and cost hike makes it impractical.

For European brands, nearshoring would mean a strong shift toward Turkey. Besides, US brands also reportedly want to take advantage of the country's capacity for design and speed.

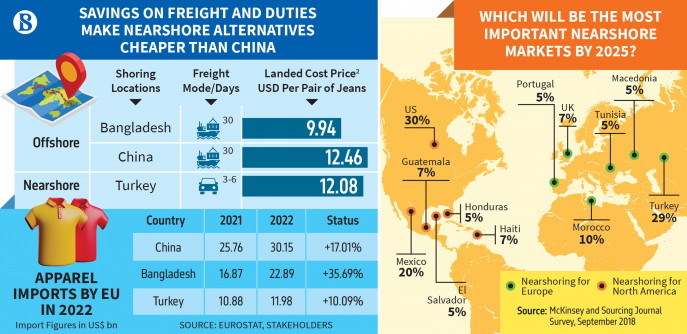

According to the McKinsey report, in response to a question with regards to their future view of the top five country hot spots by 2025, many CPOs mentioned Turkey, which stood third in the list.

Notably, Bangladesh topped the list with a significant lead against others in the list.

The prospects of other nearshoring options such as Morocco, Tunisia, Portugal, Macedonia or the UK is not significant.

In 2022, a year after the publication of the report, Turkey saw a 10.09% growth in RMG supply to the EU, being the third largest supplier to the latter. It supplied $11.98 billion worth of apparel that year.

At the same period, Bangladesh's RMG industry posted a growth of a whopping 35.69%, reaching $22.89 billion, up from $16.87 billion in 2021.

In the 2023 calendar year, of course, both countries experienced a decline in export as the apparel import of the EU from the world decreased by around 10%.

Bangladesh's apparel export to the US, its largest customer as a single country, saw a similar decline in the same year, but that too, does not have anything to do with nearshoring. The imports of RMG by the US dropped globally in 2023.

Overall, Bangladesh is still experiencing a steady upward trend in RMG export despite all the challenges. Apparel companies are continuously making new investments in the sector to attain sustainability and to ensure compliance.

The country now houses the world's top green factories, and the industry is regarded as the safest in the world, thanks to constant push and monitoring from the brands, reciprocated by the factory owners.

Increased safety and sustainability means Bangladesh's apparel products now have a better image among the brands and the retail customers.

Although these new investments are leading to increased production cost, cheap labour gives Bangladesh's RMG industry a comfortable competitive edge over other suppliers such as China, India and Vietnam.

In 2023, unit price of apparel imports in the EU increased by 5.89%, due to price hike of products from China, Turkey, Vietnam, Sri Lanka and Indonesia. During this period, Bangladesh was the only top supplier to offer a lower unit price.

Over the past decades, mass-market clothing brands and retailers from the US and Europe were eager to relocate production to Asia to gain cost advantages due to the dramatically lower labour costs there.

But it is no longer the case. The Far East has seen rising wages for factory workers, eroding its previous low cost advantage. China, for instance, has experienced a significant increase in labour costs, evolving from being one-tenth of those in the US in 2005 to approximately one-third in recent years.

While manufacturing labour costs remain higher in nearshore countries – serving the Western European market – than those in China, the gap is narrowing. For example, manufacturing labour costs in Turkey were more than five times higher than those in China in 2005, which came down to 1.6 times by 2017.

Still, nearshoring has become economically viable in some cases, driven by savings in freight and duties.

For instance, reshoring from China to Turkey is now economically viable, with landed cost prices for denim being 3% lower.

But unit costs remain significantly lower when sourcing from Bangladesh, which is why creating nearshoring options is not a direct threat to Bangladesh's apparel manufacturers when it comes to prices.

Moreover, in some nearshore countries, the gap in labour costs compared to offshore locations has disappeared, but capacity limitations hinder rapid shifts in production.

Drawing a comparison to an African 'alternative' supplier, a former German merchandiser, seeking anonymity, said that the amount of apparel manufactured in that whole country in a year is what a single factory in Bangladesh manufactures at the same time. He added that an alternative to Bangladesh is not yet there.

Mexico, another near-shore source, now boasts lower average manufacturing labour costs than China.

Still, Bangladesh outperformed Mexico and China to become the largest denim exporter to the United States in 2020. Bangladesh's clothing exports to the US grew by 36.4% to $9.75 billion year-on-year in 2022, before facing the aforementioned slump unrelated to competition.

Onshoring apparel production, on the other hand, is still out of question. According to the McKinsey report, while nearshoring reduces cost of transport, bringing the production 'home' is not attractive at all due to high labour cost.

In addition, due to compliance and ease of due diligence in Bangladesh in the wake of European due diligence legislations, the country remains a good sourcing hub, according to Heidi Furustøl, executive director of Ethical Trade Norway, an organisation that works with both brands and manufacturers.

Notwithstanding, some apparel makers say nearshoring concerns them, but for a different reason – the advent of new technology.

"Nearshoring is a reality, and not only for apparel. All European countries and Americans are trying to move away, mainly from China. In the short-term I'm not worried. But in the long run nearshoring or reshoring can happen due to technological advancement," said Navidul Huq, managing director of Mohammadi Group and a director at Bangladesh Garment Manufacturers & Exporters Association (BGMEA).

Navid said that technology is reaching such heights that it will be able to make clothes. Technology capable of doing so with minimal human touch is already here.

"This technological advancement scares me most. In 10 to 20 years, we have no idea where the technology will reach," Navid said.

The BGMEA director added that adapting such technology will not be feasible for Bangladesh because Bangladesh's comparative advantage rests in cheap labour. When the need for labour is gone, the country will lose its advantage.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel