Financial account deficit widens despite negative import growth in February

The Bangladesh Bank's rigorous efforts to reduce import expenditure and save foreign exchange reserves have yielded little result as the financial account deficit continues to widen, crossing $1.5 billion in July-February this fiscal year. This has increased pressure on the country's external position.

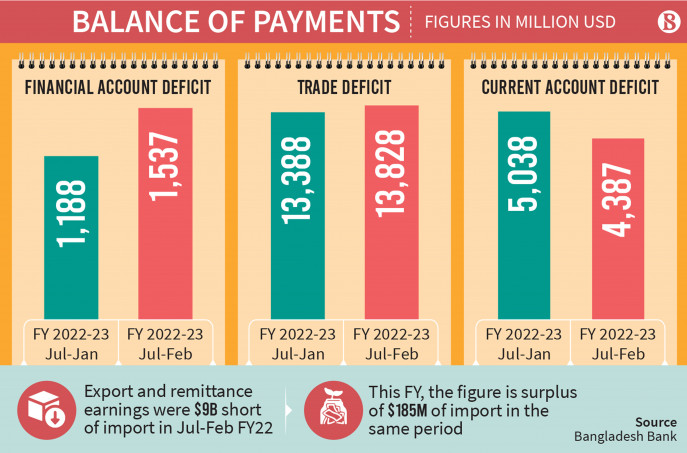

According to data from the Bangladesh Bank, the financial account deficit went up by $350 million in February alone from $1.19 billion in the July-January period because of negative growth in foreign fund inflow.

The financial account deficit has resulted in an $8 billion loss in foreign exchange reserves during the same period, as the Bangladesh Bank has had to settle all foreign payments directly from the forex reserve.

The current account balance – which includes exports, imports, remittances, and other service incomes – is the primary source of foreign payment. When this account turns negative, the central bank settles foreign payments from the financial account, which includes foreign direct investment, foreign loans, and portfolio investments of non-resident Bangladeshis.

The foreign exchange reserve is the last resort for foreign payments when the financial account also turns into a deficit.

During the July-February period of the current fiscal year, both the current account balance and the financial account were in deficit, forcing the central bank to make payments from reserves and further worsening the external position.

In contrast, in the same period of the previous fiscal year, the financial account had a surplus of $12 billion, while the current account balance was negative $13 billion. As a result, the central bank spent less from foreign exchange reserves for foreign payments that year, using only $2 billion from the reserves in July-February.

The gross forex reserve came down to $32.29 billion in the July-February period of the current fiscal year from $46.13 billion in the same period a year ago, the central bank's data show.

On the other hand, negative import growth helped to improve the current account deficit slightly to $4.3 billion in the July-February period from $5 billion in the July-January period of the current fiscal year.

In the July-February period this fiscal year, Bangladesh's imports logged a negative 10.27% growth while exports grew by 9.45% and remittance receipts by 4.27%, according to the Bangladesh Bank.

The combined figure of export and remittance earnings crossed the import expenditure in the July-February period although the figure was usually $9 billion to $10 billion short of import expenditures previously.

The export and remittance earnings totaled $48.97 billion in the first eight months of the current fiscal year while the import spending was $48.79 billion.

Despite the drastic fall in imports, Bangladesh's trade deficit widened to $13.8 billion in the July-February period from $13.38 billion in the July-January period of the current fiscal year.

Restricting imports is not the means of improving a country's external position, observed Zahid Hussain, consultant of the World Bank Dhaka Office, while addressing an event on releasing Bangladesh Development Update April 2023 held on Tuesday.

He argued that Bangladesh cannot save reserves by restricting imports, instead, slow imports will hurt the economic activities as investors could not import required raw materials for investment. If the economic activities lose momentum, then it will put further pressure on the reserves, he added.

The Bangladesh Bank's financial account component shows that the inflow of medium and long-term foreign loans declined by 19.33% in July-February of the current fiscal year compared to the same period of the last year, which reflects a slowdown in investment.

Trade credit which is taken for capital machinery from foreign banks by importers turned to a negative $2.52 billion in July-February of the current fiscal year from a surplus of $1.46 billion in the same period of the last year.

The negative trade credit figure shows that the Bangladesh Bank paid more against foreign loans than the sum received during the period.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel