Taka losing more value as global currency market volatility persists

The US dollar is getting stronger. Bangladeshi taka, like most major and minor currencies across the globe, looks set to stay in stress so long as import bills, inflated by global commodity price volatility, continue to overrun foreign currency inflows mainly through exports and remittances.

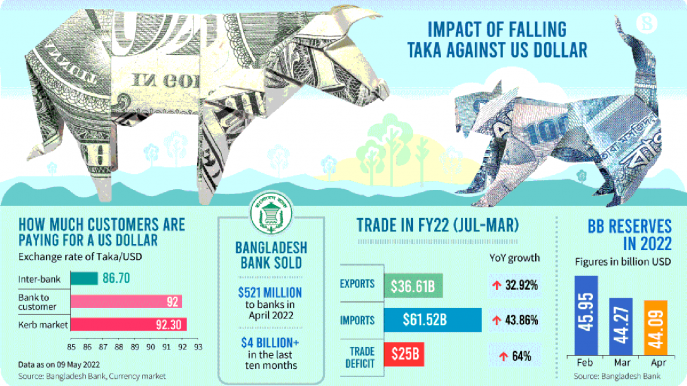

The interbank exchange rate was raised by Tk0.25 to Tk86.7 per dollar yesterday, the second increase in less than two months. It is the rate between two banks. Customers have to pay at least Tk7 more per dollar.

Even banks are paying much higher than the quoted rate to buy dollars from other banks to meet urgent needs of business clients as they are not getting enough dollars from the central bank.

This additional cost adds to the cost of business.

Even the high-priority purchase of fuel oils is also in trouble. The state-owned fuel oil monopoly Bangladesh Petroleum Corporation is facing delays of 5-10 days in opening import LCs (letters of credit) for not getting enough dollars from the Bangladesh Bank in time at the prescribed rate. It got approval from the energy ministry last month to purchase dollars at the market rate if needed.

As the US dollar has been stronger for weeks than major currencies, the latest rate hike by the Federal Reserve gave a further boost to its strength.

The king of currencies is now at its highest level in 20 years compared to rival currencies including the euro, one of four reserve currencies in the global financial system.

The US central bank raised its benchmark interest rate last week in its bid to check fast rising prices with inflation at 40-year high.

Taka loses 25 paisa against dollar

Bangladeshi taka has lost its value by 25 paisa in the span of a day. In the interbank exchange market, taka traded at 86.7 per dollar on Monday, up from Sunday's 86.45.

Talking about it, seeking anonymity, the treasury head of a private bank told The Business Standard that the dollar market has now been in a tight situation because there is more demand for outflow than inflow.

The Bangladesh Bank yesterday raised the dollar rate by 25 paisa after having reviewed the overall market.

But the greenback does not trade at the central bank-fixed rate in the interbank exchange market because the market rate is higher, he said.

Besides, banks are not getting dollars from the central bank in proportion to the number of LCs they have opened. That is why they are buying dollars at higher prices from the market.

"We have an extreme dollar crisis. We are not getting greenbacks from the central bank for making big payments. The dollars we are getting from the central bank is not even half of what we need; so, we have to spend an extra Tk5-6 to purchase dollars from the market, causing banks to suffer financially," the official pointed out.

The value of taka fell to Tk86.45 per dollar in the interbank exchange market on 9 May, which was Tk84.80 on the same day in 2021.

Exchange market had more or less been stable at Tk84-85 level for three years till 2021, before reaching Tk86 per dollar in January this year. The interbank exchange rate reached Tk86.20 in March and remained the same till late April.

Although the exchange rate was Tk86.7 in the interbank market, banks sold dollars to customers at Tk90-Tk92. In the kerb market, it was sold at Tk92-93 on Monday.

The local currency has been losing its value against the greenback due to increasing value of imports on the back of spiralling global prices of goods due to the pandemic and the Russia-Ukraine war.

As the economy started reviving from the pandemic hiatus, demand for imports of crude oil, food commodities and industrial raw materials surged. Skyrocketing global price of everything largely contributed to 44% growth in import values in the nine months to March of the current fiscal year.

Although exports posted about 33% growth in the same period, it could not hold back trade balance sliding into a deficit of about $25 billion in nine months, which was 9% higher than that of the whole previous fiscal year.

The current account is also in the red, with a deficit exceeding $14 billion despite some growth in remittances in recent months.

Global central banks, including the Bank of England and the Reserve Bank of India, are raising key interest rates to control imports to keep soaring inflation in check.

Should the Bangladesh Bank weigh a similar option to check imports from further inflating? Or, should it release more dollars into the market to normalise the exchange market?

Such thoughts are coming to the fore as the US dollar is getting pricier, breaking exchange rate stability for years.

The foreign exchange reserve, seen as a strong defence against any external sector vulnerabilities, has also been declining, limiting the central bank's role to intervene by buying or selling dollars "to maintain orderly market conditions".

When import demand bottomed during Covid-19, the central bank had bought dollars from banks, which helped it raise foreign currency reserves to $48 billion in August last year.

As demand for the dollar rose due to increased imports, the central bank started selling dollars as per the demand, releasing $521 million to banks in April alone. The Bangladesh Bank sold over $4 billion to banks in the last nine months, Md Serajul Islam, an executive director and spokesperson of the central bank, told TBS last month.

With reserves dipping to $44.15 billion in March from $45.8b in the previous month, the central bank seems to be cautious in intervening as treasury officials of some banks have told TBS that they were not getting enough dollars from the central bank as they asked for.

The reserve is set to fall by $2 billion more after Asian Clearing Union payment due for today.

What BB can do now

Inflation was not in concern so far as it averaged 5-6%, but now it seems that the official rate does not reflect the reality, says Dr Salehuddin Ahmed, former governor of the Bangladesh Bank.

If you look at the purchasing power of people, the real inflation might be quite higher, he feels.

"It is the practice when inflation goes up the currency is depreciated or devalued to some extent to help exports stay competitive. But it is not being done in Bangladesh. And they [authorities] are managing things on a piecemeal basis," observes Dr Salehuddin Ahmed.

"It is time to think about inflation, our competitiveness and exchange rate," he says.

He also feels that the recent increase in private sector credit should be looked into to see whether the money went to productive sectors.

"Time has come to be cautious in monetary policy and revisit the interest rates," he tells TBS. "Loose monetary policy benefits the big players, small fries in fact do not get loans at low interest rate," he points out.

On the widening gap between the dollar rate in banks and the kerb market, the former central bank governor says it is not a good sign and suggests that regulators check if there is any currency flight out of the country.

"The wait-and-see policy will not bring any good. Crisis snowballed in Sri Lanka over the last 4-5 years as the country did not act upon properly to set things right. I wish Bangladesh will not walk the same path."

Raising interest rates reduces import demands and thus keeps dollar demands and inflation in check.

But there are concerns that ending the soft monetary stance and raising key policy rate will make money costlier for businesses.

Dr Salehuddin says policy rate must be revisited as he believes there are many other factors that need to be improved to help businesses recover fast from the pandemic.

"If other bottlenecks remain unchanged, lower interest rates alone cannot help businesses prosper," he views.

It is not a crisis for dollars, but it is a pressure on taka, which may persist for some more time, says Syed Mahbubur Rahman, managing director and chief executive officer at Mutual Trust Bank Limited.

As import growth surpassed export rise and trade deficit shot up, creating further pressure on the foreign currency situation, the central bank is using its reserve holdings cautiously, he says.

But Bangladesh should not opt for raising the key interest rate right now, he feels.

Apart from initiatives to boost exports and remittances, the senior banker feels the urgency for vigorous drive for foreign investment to help the country ride out the currency volatility.

Pricier dollars are costing businesses, and consumers are the ultimate sufferers, says Rizwan Rahman, president at Dhaka Chamber of Commerce and Industry.

"Currency market volatility may persist for at least three-six more months. Businesses have to feel the shock until the currency market stabilises somewhere after price correction," he also says, hoping that the problem might be a temporary one.

Since it is a global phenomenon and developing every other day, the trade body leader suggests that the central bank should keep a close eye on the "graph".

"If it does not look volatile, then observe further. For any irrational step taken abruptly may invite more problems," Rizwan says, when asked if the central bank should hike rate or devalue taka.

Humayun Kabir, executive director and acting spokesperson at the central bank, told TBS, "Our imports were low during the pandemic. At that time, the central bank purchased surplus dollars from the banking system to keep the forex market stable. As a result, the country's reserves reached $48 billion in August last year."

Forex reserves have now dropped a bit because of a rise in imports in post-pandemic times and their higher payments caused by rising product prices in the international market.

To lessen pressure on reserves and keep inflation in check, the Bangladesh Bank can put some restrictions in force on imports even without hiking its policy rates, such as repo and bank rates. And, the central bank is doing so.

The central bank has a 25% margin on the opening of LCs for non-essential items to keep off pressure on the forex reserve. Besides, the dollar rate has been raised from time to time based on demand and supply.

Thus, imports will drop a bit and inflows of remittances through formal channels will go up, Humayun Kabir noted.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel