And then it got worse: How Ukraine crisis could sink global economy

Russia supplies around 40% of Europe's gas

Nero fiddles while Rome burns. The first century CE myth will not match the 21st century reality. The world is now more connected than ever before. Now when Ukraine burns, Neros all over the world stand to get their hands burnt too. While sanctions put Russia in a tight spot, Europe is in hiccups for future supply of gas it will need to keep homes warm. Wall Street, where money never sleeps, has started recalling the stagflation that followed the oil crisis in the 1970s. Though there were no bombs in the USA, president Nixon's top adviser had called the oil shocks "an Energy Pearl Harbor" as the oil embargo had stunned Americans.

While Bangladesh's energy minister has been in the Middle East to look for long-term gas deals, energy ministers from European Union countries are discussing preparations for potential energy supply shocks following Russia's strike on Ukraine.

The EU had sufficient gas and oil stocks to withstand short-term disruption, but there is an issue on long-term supplies, Reuters quoted France's ecological transition minister as saying.

Russia supplies around 40% of Europe's gas.

Even before the war broke out, the US State Department's special envoy for energy affairs had flown to Riyadh last month for talks about managing the potential impact on oil markets.

Western governments have also stepped up efforts for alternative energy supplies to reduce reliance on Russia.

Italy's foreign minister is visiting Algeria in search of gas. Import meets 90% of its gas demand and most supplies come from Russia and Algeria.

Germany, apart from plans to build two LNG terminals to enhance gas storage facilities, aims to speed up its wind and solar energy projects, reports Reuters. The economy minister of Europe's largest economy has said faster expansion of renewables is key to reducing dependence on Russian fossil fuels.

However, Germany has already been on a plan to exit nuclear power this year and coal-fired power by 2030.

But switching over to renewables overnight is not easy for most of the world. Crude oil surging past $100 a barrel will not mean a quick global transition from fossil fuels to clean energy options. It will rather encourage more investment in drilling to gain more from oil proceeds and give a boost to electric vehicle sales as happened in 2008 when oil nearly broke $150 a barrel.

Sanction card vs oil cards!

With Russian missiles hitting Ukrainian targets, killing people and destroying the economy, powerful countries are playing cards for booking their own gains from the war. The USA and Europe have used their sanction cards on Russia, while Russia, aided by its allies in the Organization of the Petroleum Exporting Countries (OPEC) has its card to play.

Saudi Arabia's crown prince is not lagging behind too. As an OPEC heavyweight, Crown Prince Mohammed bin Salman is readying his oil card to resist US pressure to pump more crude to lower the price of oil. Besides, he is choosing to keep Riyadh's oil pact with Moscow alive, Reuters reports quoting Saudi government sources.

As oil prices have surged to the highest since 2012 on concerns about supply disruptions, the world is left with little spare capacity to pump more crude.

Washington would like OPEC+ to pump more oil to help reduce prices. But the producers' alliance and its allies led by Russia are still unwilling to move away from output cuts they instated in 2020 to boost prices after the coronavirus pandemic caused an unprecedented fall in global demand.

Worst to come?

Worries will not be limited to fuel supplies alone. It is a little over a week since the Russia-Ukraine war broke out. If it prolongs, it will bleed the global economy white as it has already triggered a massive rally in the global commodity market on fears of supply crunches.

Both Russia and Ukraine are major sources of global food grains, while Russia supplies energy, metals and raw materials for many industries that cannot easily be moved over to alternative supplies.

Prices from crude to aluminium and wheat soared, as raw materials staged their most stunning weekly surge since 1974 and the days of the oil crisis, says a Bloomberg report, hinting at potentially prolonged shortages and sharper global inflation.

Traders, banks and ship owners are increasingly avoiding business with Russia because of the difficulty in securing payments, while shipping lines are either cancelling or not taking bookings from the region.

The mood on Wall Street feels like a return to the 1970s, with some investors thinking stagflation, a situation when inflation rises and growth slows, is not far off. They are recalibrating their portfolios for an expected period of high inflation and weaker growth, says a Reuters analysis.

The last major stagflationary period began in the late 1960s. Spiking oil prices, rising unemployment and loose monetary policy pushed the core consumer price index up to a high of 13.5% in 1980 in the US.

During 1973-1979, oil supplies had dropped and prices soared, and senior Americans can still remember the memories of those hard days – dark Christmas trees, cars returning with empty tanks from pumps, running short of oil to heat homes or run factories.

All had stemmed from OPEC's embargo on oil supplies to the US after the 1973 Arab-Israel war. Americans had thought that their luxury of big cars, lavish consumption and large farmhouses was over.

The 1973 oil crisis caused a decline in GDP of 4.7% in the United States, 2.5% in Europe, and 7% in Japan. According to the US government, the 1979 increase in oil prices caused world GDP to drop by 3% from the trend.

The price increase following the first oil crisis raised consumer payments for oil by approximately $473 billion (in real 1999 US dollars), whereas the second oil crisis increased consumer expenditure by $1,048 billion. By contrast, the oil price hikes during 1999-2001 raised consumer expenditure by $480 billion.

Taking lessons from the 1973 oil shocks, the US had invested heavily on domestic energy sources and succeeded in reducing energy import dependence.

But things will not be easy for Europe if oil supply concerns deepen and prices soar further.

There are worries that stagflation may hit Europe harder due to its heavier reliance on energy imports.

Stagflation in Europe would likely resemble the long period of low growth and high inflation the United States experienced in the 1970s, Paul Christopher, head of global market strategy at Wells Fargo Investment Institute, told Reuters.

"In Europe, if energy prices go too high, then factories will have to shut down," he said.

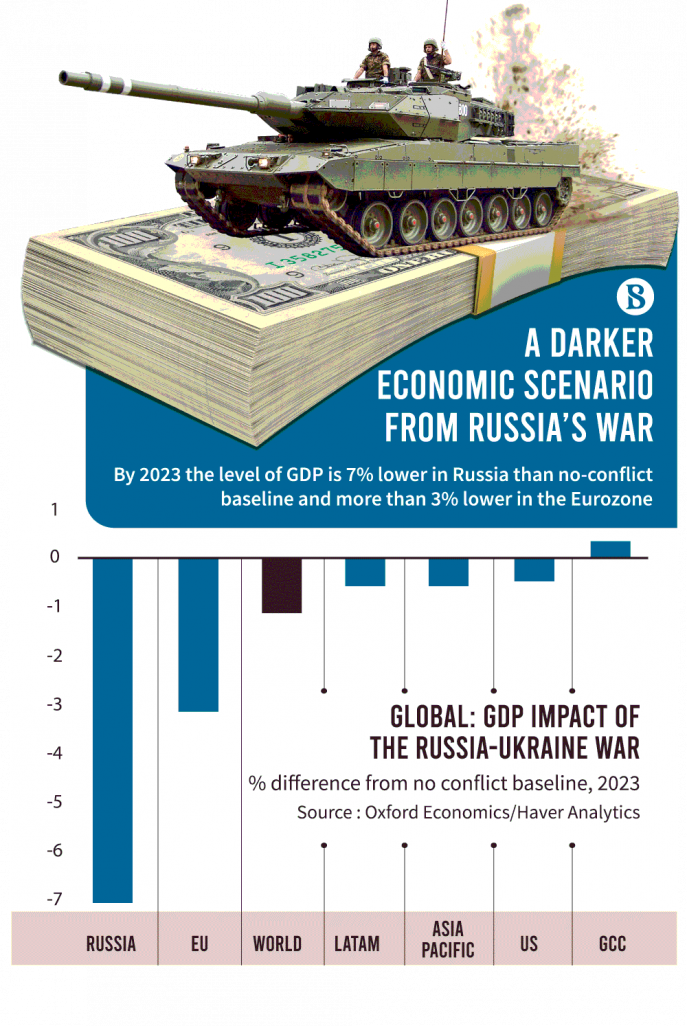

Oxford Economics forecasts a darker future for the global economy if the fighting in Ukraine lasts well into 2023, the West imposes further sanctions and Russia retaliates by restricting gas supplies.

In this downside scenario, the impact on Russian GDP is very severe as it may contract by 3.1% in 2022 while the Eurozone GDP growth will slow to 2.2%, the forecast says. The impact on the level of global GDP is significant at 0.6% in 2022 and 1.1% in 2023, with the spillovers to the Americas and Asia being mild, predicts Oxford Economics.

After a 90-minute conversation with Russian President Vladimir Putin, his French counterpart Emmanuel Macron believes "the worst is to come" in Ukraine as Russia looks firm on "de-Nazification" of Ukraine, said an AFP report Thursday, quoting a senior aide to the French leader.

Commodity prices in Bangladesh have already taken a hit from global market volatility due to fears of supply crunch at a time when global supplies were still bearing the brunt from pandemic-induced disruption and sky-high freight costs.

Businesses have already aired their concerns over exports to and imports from Russia and Ukraine. Concerns are there over transactions with Russia, which is supporting Bangladesh's lone nuclear power plant.

As the Black Sea route has already turned dangerous, merchandise trade will take further blows.

Bangladesh has already paid a huge price as the Russian strike in the Ukrainian port hit a ship and cost the life of a sailor. Nobody knows what more is in store for Bangladesh as well as the world.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel