Top drugmakers keep growth trajectory in H1

At present, the pharmaceutical market in the country is around Tk30,000 crore and the companies are exporting medicines to more than 100 countries

Pharmaceutical companies are doing good business in line with the growing demand for medicines in the country and they have maintained the growth in the first half of the current financial year.

Large drug manufacturers listed on the capital market have reported good growth in the business while small companies suffered a decline mainly because of the Covid-19 pandemic.

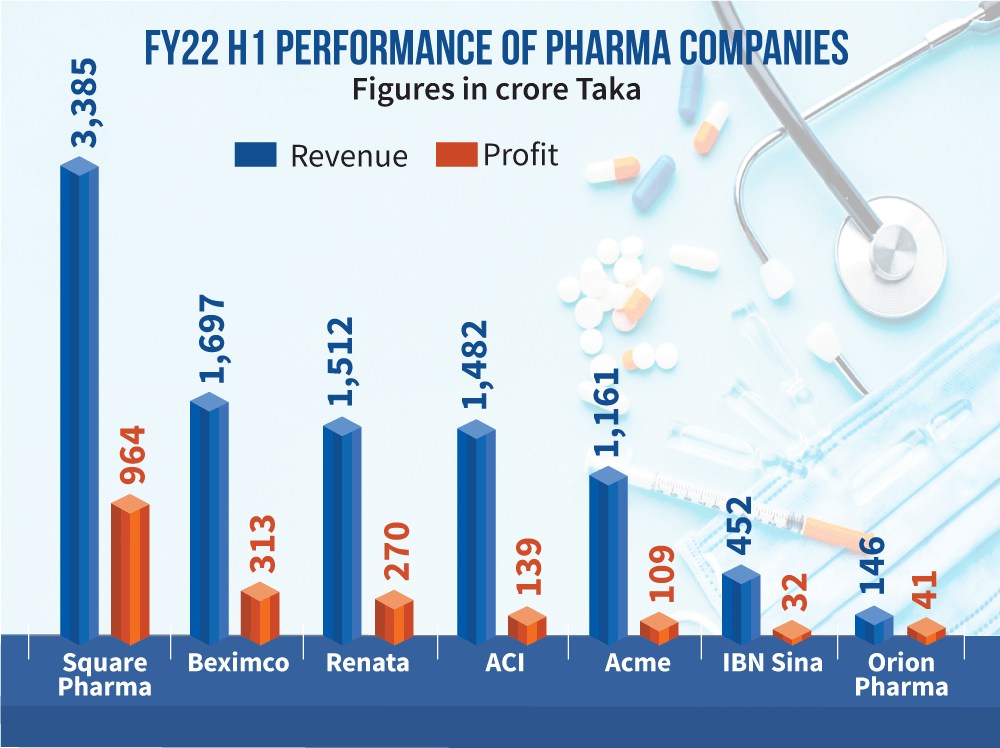

Among the top drugmakers, Square Pharma posted a 16% growth in sales, Beximco 18%, Renata 17%, ACI 9%, Acme 16%, IBN Sina 25% and Orion Pharma 13%.

Analysts in the stock market say pharmaceutical companies are in sustainable growth in the current sector-based business. The pandemic has further accelerated the business of the companies. Investors are also getting good returns from this sector. Also, foreign stock investors prefer the pharmaceutical sector.

Professor Firoj Ahmed, pharmacy department chairman at the Dhaka University, said due to urbanisation and pollution, people are increasingly facing various health problems alongside a rise in their income. As a result, the per-capita expenditure in the health sector is also on the rise.

"Demographic factors and increased spending power boost sales of any product. Our pharmaceutical industry is also in the line and the growth potential of the sector is huge," he added.

In a study report titled "UCB Asset Pharma Outlook in The Fresh Decade", UCB Asset Management recently said the industry would reach the Tk1 lakh crore milestone by 2030 mainly riding on the growing local market demand.

Alongside a local market boom, the country's pharmaceutical sector is expected to rake in over $1.5 billion or around Tk13,000 crore in export earnings per year by 2030 – almost nine times higher than the $169 million earned in FY21.

At present, the pharmaceutical market in the country is around Tk30,000 crore and the companies are exporting medicines to more than 100 countries.

Companies like Square, Beximco, Renata, ACI and Acme are leading the market.

However, the World Bank says, among the regional peers, Bangladeshi people spend the least portion of their income on healthcare – only 2.4% to lag behind Pakistan, Indonesia, India, the Philippines, Thailand, Myanmar, Nepal and, of course, Vietnam where the ratio is the highest in the region at 6.4%.

Waiver from the World Trade Organisation's Trade-Related Aspects of Intellectual Property Rights (Trips) agreement as a least developed country has been the most important aspect behind the Bangladesh pharmaceutical industry's growth and the facility will expire after 2032 as the country is graduating its economic status upwards.

Bangladeshi drugmakers will be allowed to develop generic versions of patented drugs until 2033 and even after that the Trips adherence is unlikely to affect the industry massively as over 85% of the generic drugs produced now by the industry are off-patent ones, which need no royalty payment to patent owning companies.

The slowed-down pace in drug patent registration globally is unlikely to change the scenario drastically, especially for widely consumed medicines, the UCB Asset Management report anticipated.

"Even being Trips compatible after 2032, the availability and price of generic drugs might remain unaffected," it added.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel