Dividend distribution policy made mandatory

The securities regulator has issued a comprehensive directive to reform the way a company announces and disburses its dividends

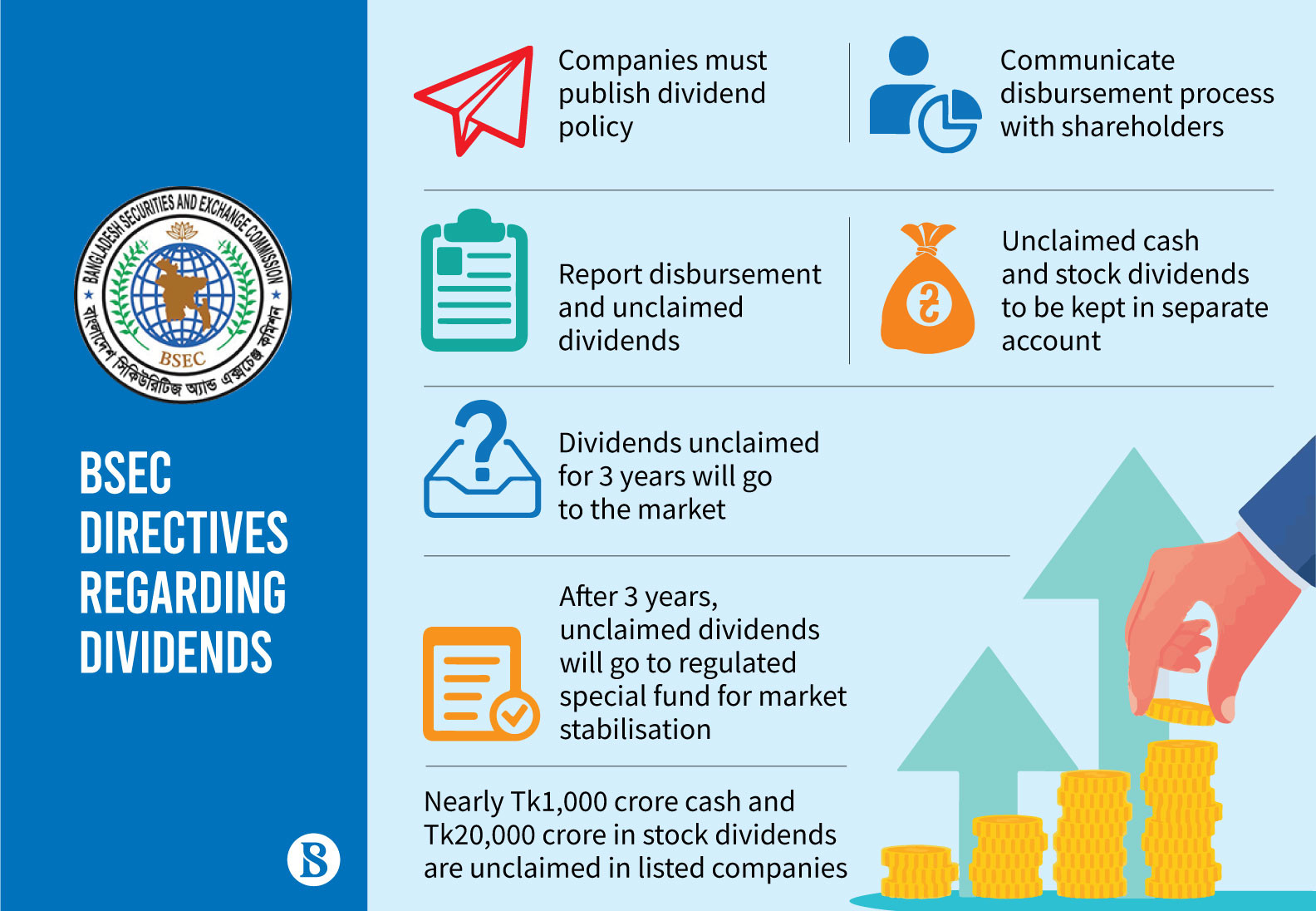

All listed companies and mutual funds must formulate their dividend distribution policies and publish them in their annual reports – as well as on their official websites – so that investors can anticipate how much dividend they might avail.

Analysts praised the regulatory direction because investors across the developed stock markets depend a lot on such disclosures by listed companies.

The Bangladesh Securities and Exchange Commission (BSEC) recently issued a comprehensive directive to reform the way a company announces and disburses dividends.

The regulator also made it mandatory for companies to communicate dividend disbursement information to investors as well as report updates on disbursement.

Companies and mutual funds also have to keep all unclaimed cash and stock dividends in separate accounts and those would be transferred to a proposed special fund after three years.

However, any investor claiming the cash or stock dividends, upon proving their ownership, would get it back in 15 days with accrued interest added.

According to a compilation by the two stock exchanges, listed companies and mutual funds have nearly Tk1,000 crore in undisbursed cash dividends because of no claim from shareholders.

The issuers also reported undisbursed stock dividends worth nearly Tk20,000 crore a few weeks ago.

"The state-owned Investment Corporation of Bangladesh [ICB] will manage the assets of the planned special fund with a view to making the market," BSEC Chairman Professor Shibli Rubayat-Ul-Islam recently said at a webinar.

A BSEC official told The Business Standard that the fund would remain under trustee's responsibility.

Alongside utilising the cash pile, the fund manager would also use the securities for market stabilisation – be it by borrowing cash against the securities or direct trading of the securities.

In the recent directive, the regulator also said issuers have to set aside funds against announced cash dividends within 10 days of a board meeting. Meanwhile, companies would get 30 days for disbursement for dividends approved at the annual general meeting (AGM). Mutual funds would get 45 days.

If investors have no bank account for an electronic funds transfer, the issuer would try other regulated ways to disburse dividends and if there were no way to reach the investors, issuers must set aside the amounts in a separate account.

Stock dividends must be disbursed in 30 days of an AGM.

Issuers must communicate transactions with investors through SMS or e-mail.

Why the unclaimed dividends mounted

According to stockbrokers, there have been many investors who are neither in touch with the stock market nor the issuers concerned. Some have died and their nominees are not in touch, some have gone abroad and do not follow up with their financial assets on the local stock market.

Some listed companies have decades-old shareholders who do not even have beneficiary owner accounts.

Also some of the issuers have not been cordial enough to get their cash dividends disbursed properly.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel