Moody’s new ratings to make business costly

In case the rating of an importer’s bank is negative – which five Bangladeshi banks got this time – the exporter’s bank seeks confirmation through a second bank

Banks whose ratings were downgraded by Moody's last week will need to count more for their Letter of Credit (LC) operations.

Most Bangladeshi banks need to have their LCs confirmed by a foreign bank in which the seller has a payment guarantee.

Exporters' banks want assurances that importers' banks will make payments once goods are delivered. It is for this reason that exporters' banks look at the credit ratings of importers' banks.

In case the rating of an importer's bank is negative – which five Bangladeshi banks got this time – the exporter's bank seeks confirmation through a second bank.

And now that the five banks - Al-Arafah Islami Bank, Dutch-Bangla Bank, Eastern Bank, Mercantile Bank, and Social Islami Bank – have had their ratings downgraded, they will have to pay more for confirmation of their LCs by a second bank.

"This will push up the cost of business of the banks," said a senior banker of a foreign bank operating in Bangladesh. "The banks will either pass on this cost to the importers or, to retain business, will have to internalize the costs. This will reduce their profitability. It is good news for us, though, because we will earn more just by guaranteeing LCs."

LC confirmation is mostly needed in case of commodity imports and for Bangladesh, a heavy importer of commodities, the additional costs will add up to essential prices too.

In addition to individual banks' ratings, the exporter's bank also considers the sovereign rating of a country. Moody's had rated Bangladesh a Ba3 sovereign rating supported by its stable and strong growth performance and modest debt burden.

But worryingly, Moody's this time has downgraded Bangladesh's Macro Profile to "Weak-" from "Weak", by introducing a negative one-notch adjustment to Credit Conditions.

"This will certainly push up transactional cost for the banks," said a senior banker wishing to remain anonymous.

Zahid Hussain, a former lead economist at the World Bank in Dhaka, says Moody's new rating means increased transaction costs for banks internationally. LC confirmation fees are likely to rise further. Confirmation fees are a security mechanism that eliminates risks for foreign exporters, he stated.

"When they are not satisfied with the LC-issuing bank mainly because of its insolvency risks, they want an additional guarantee for the LCs. LC confirmation charges were higher for Bangladesh to begin with, compared with Vietnam, India, Pakistan, etc.

"In offshore banking, the volume of Usance Pay at sight (UPAS) has been increasing and Bangladeshi banks have been borrowing from foreign banks to meet their payment at sight obligations under UPAS. Interest rates on these borrowing may rise to reflect the increased risk premium resulting from the downgraded Macro Profile," Zahid told The Business Standard.

"Thus, the international competitiveness of Bangladeshi exporters, which was already being stressed, may confront more challenges down the road," he added.

Zahid Hussain thinks Moody's downgrading of the Baseline Credit Agreement is bad news not just for the six banks whose BCAs have been downgraded, but also bad news for Bangladesh's banking system as a whole.

"This is because they have expressed serious reservations about the outlook for asset quality and profitability of banks in Bangladesh, taking into account the policy package allowing declassification and of default loans and their rescheduling on easier terms.

"This has increased the riskiness of the assets of the banking sector as a whole. Consequently, they have downgraded Bangladesh's macro profile by a negative one-notch adjustment to Credit Conditions," said the economist.

That Bangladesh's banks will get a bad rating this year was on the cards as the country's soured loans piled up.

The recent changes in loan classification that have deferred the default recognition of term loans and introduction of a one-time package that allows default loans to be declassified and rescheduled on relaxed terms also led to Moody's downgrading the ratings.

In March 2019, Moody's warned that the rating could be downgraded for three reasons.

First, if the country's debt burden increased sharply, possibly through large borrowing to fund infrastructure projects that do not provide commensurate economic returns and, secondly, if the banking sector's financial health weakened, particularly for state-owned banks, with rising contingent liability risks to the government.

Thirdly, Moody's said bad ratings could come if political tensions led to an undermining of macroeconomic policy stability.

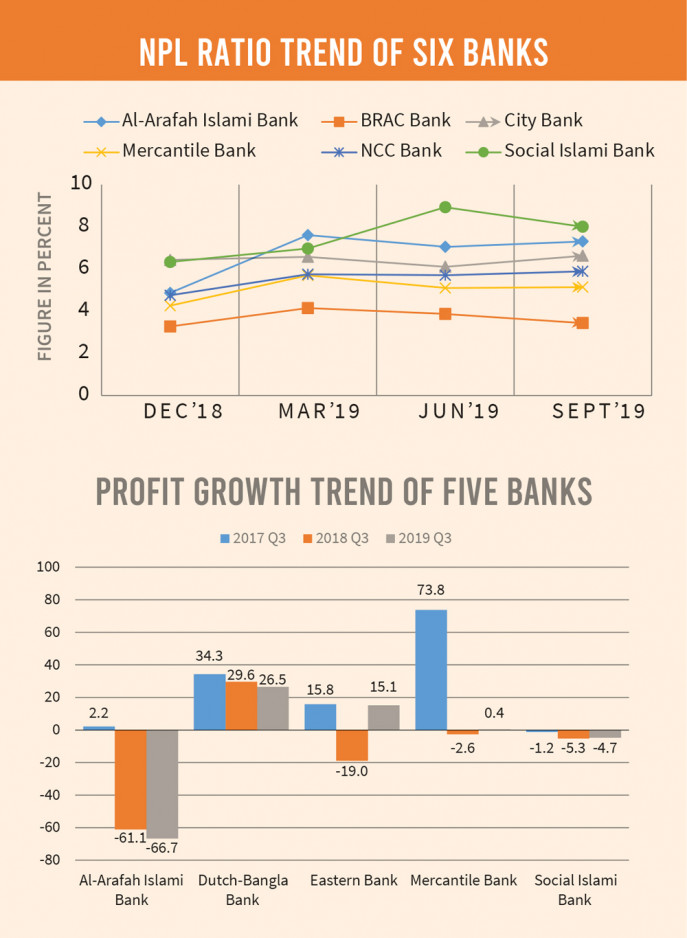

The deterioration in credit conditions will weigh on the asset quality and profitability of banks in Bangladesh.

This year, the central bank has deferred the default recognition of term loans, and introduced a one-time package that allows defaulted loans to be declassified and rescheduled on relaxed terms, on top of existing policies that allow banks to reschedule problematic accounts.

Banks with elevated levels of problem loans — including rescheduled and stay order loans — and high concentration risks in corporates will be vulnerable to the rising asset risks.

Moody's downgrading was based on rising default loans, rescheduling and eroding profitability, said Mashrur Arefin, managing director of The City Bank.

He said these problems will deepen further in future as enforcement of single digit lending rate will erode profit margin of the banking sector and loan rescheduling will increase significantly until January under a special rescheduling policy.

His bank was downgraded due to concentration on corporate loans and rescheduling spree, he said.

"We are planning to reduce the corporate portfolio and go for small and medium lending to increase profitability," he added.

The banking sector has been going through various pressures and that's why Moody's has downgraded the overall banking sector, said Selim RF Hussain, managing director of BRAC Bank.

The degradation of rating will increase foreign transaction costs, he said.

Foreign banks may increase add confirmation fees due to rising risk of banks, he said.

However, BRAC Bank will not face problem in add confirmation because its credit assessment rating is strong, he said.

Recently, China blacklisted some Bangladeshi banks due to their failure in payment and the degradation by Moody's will hurt their reputation further before the foreign banks, according to Nurul Amin former chairman of Bangladesh Foreign Exchange Dealers' Association (BAFEDA).

He said add confirmation charge is already high in Bangladesh at an average of 3 to 4 percent when the standard rate is 1 to 2 percent.

The downgrading will further increase foreign transaction costs for importers and exporters, he said.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel