Deposits in banks rises by Tk25,000cr in April

Deposits in banks increased by about Tk25,000 crore in April, reflecting the customers' growing confidence despite a 9% inflation rate in the last few months.

However, deposits in Islamic banks did not increase much; rather, the amount of excess liquidity in a number of such banks has dropped in the first quarter of this year.

According to the Bangladesh Bank's data, the total amount of bank deposits stood at 15.48 lakh crore at the end of April, which was Tk15.23 lakh crore in March.

The bulk of the increased amount – around Tk20,000 crore – in April was time deposits of various tenures, while the rest were demand deposits.

The managing directors of several banks told TBS that the customers have been regaining confidence in the banking sector, but it has not been happening equally in all banks. Many customers still do not feel confident to make deposits in Islamic banks. So, they are depositing money in conventional banks, because those have not yet experienced any major scam.

Besides, several conventional banks have been performing well under good governance, so they are attracting more deposits, said bankers.

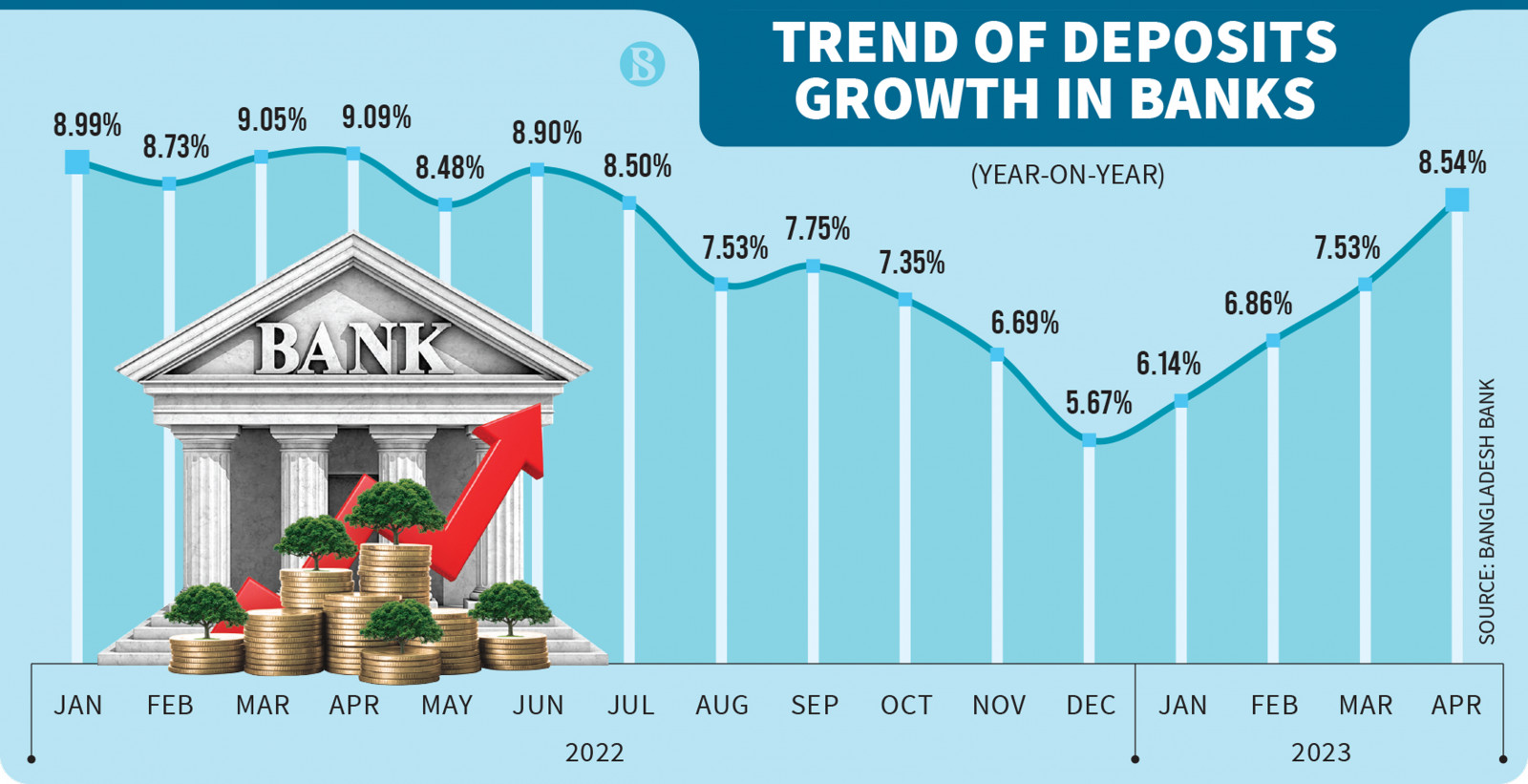

According to the central bank, the deposit growth in April was a 10-month high of 8.54%. Earlier, deposit growth fell below 6% in December last year due to irregularities in loan disbursements in a number of Islamic banks. However, the growth rate has been increasing since then.

Afzal Karim, managing director of Sonali Bank, told TBS that the amount of deposits in the state-owned banks is increasing compared to the previous period. During the November-December period of 2022, there was a crisis in the banking sector due to some rumours, which has been vanishing recently.

The growth in loans was not as good as the deposit growth. The total amount of loans disbursed by banks in April rose by Tk6,576 crore to Tk14.35 lakh crore, compared to the previous month, according to the central bank.

Mentioning a decrease in opening letters of credit (LCs) for imports as one of the reasons for the low loan growth, the managing director of a private bank told TBS that the demand for loans is created in the private sector when the number of LCs increases. Currently, the number of LCs has come down a lot, so the amount of loans dropped too.

Earlier, LCs involving around $7 billion were opened per month on an average, but currently it has come down to $4-5 billion. Besides, investment in the country is dropping due to the hike in fuel, gas, and electricity prices.

The amount of "currency outside banks" or cash held by people increased by Tk8,705 crore in April compared to March. Considering the year-on-year growth, it was the lowest – 11.23% – in nine months, the central bank said.

This growth crossed 27% in December last year. That means people are more interested in depositing money in the bank instead of keeping it at home. This is also a reason for increasing deposits in the banking sector, said bankers.

Islamic banks' deposit growth drops significantly

The growth of customer deposits in the country's banking sector has increased significantly, but the flow of deposits and excess liquidity in Sharia-based banks have decreased significantly, according to the central bank's report on "Developments of Islamic Banking in Bangladesh (January-March 2023)".

According to central bank data, deposits in Islamic banks increased by Tk5,170 crore or 1.38% in the January-March quarter of 2023 as compared to the same time previous year.

The deposit growth rate at the Islamic banks during the same quarter in the years from 2018 to 2022 period was over 15%.

The amount of loans disbursed by the Islamic banks increased by 13.45% or Tk46,011 crore in the first quarter of this year, which was the highest compared to that in the same period of the last four years.

The managing director of a Sharia-based bank told TBS on condition of anonymity that all financial indicators of Sharia-based banks were better than other banks. However, the growth of deposits has slowed down this year due to the rise in inflation caused by the global crisis.

Besides, reports on irregularities regarding loans in a number of Islamic banks have been published since December last year. That has affected all the Islamic banks. Consequently, customers have withdrawn money instead of making new deposits, he added.

According to the central bank's report, the drop in Islamic banks' excess liquidity in the first quarter of this year was the biggest in the last five years.

Excess liquidity in Islamic banks at the end of March 2022 was Tk25,137 crore, which has come down to Tk1,990 crore at the end of March this year – a 92% drop.

A senior official of the Bangladesh Bank told TBS excess liquidity at Islamic banks decreased because the amount of loans they disbursed was several times higher than the deposit he received. In general, Islamic banks' loans and assets have increased but their liquid assets have decreased due to which they have faced a crisis.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel