Opec+ decision to cut oil prices: Is the US-Saudi marriage on the rocks?

In July of this year, when the US President Joe Biden fist-bumped Saudi Crown Prince Mohammad bin Salman – the same man whose Kingdom he threatened to turn into a 'pariah' for the killing of journalist Jamal Khashoggi only two years earlier – he must have swallowed quite a bit of his pride.

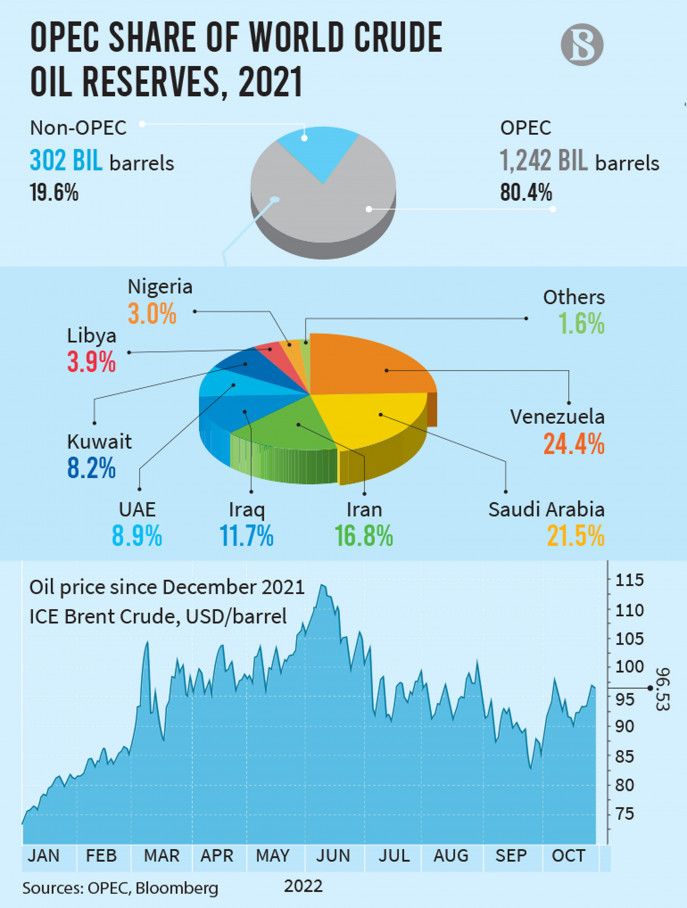

But Biden at that point had little option. Oil prices had shot up from $79 a barrel in December 2021 to $127 two weeks after Russia invaded Ukraine in late February, and Biden had to take desperate measures to keep together the unprecedented coalition he had put together to bear heavy economic sanctions down on Russia. Saudi Arabia is by far the biggest producer of oil in the world and sans Russian oil, it was imperative that the Kingdom increased its oil production to keep global oil prices stable. In fact, the US had even made overtures to its archenemy Venezuela for that same reason, as high energy prices were, and still are, causing inflation in Europe, in emerging economies and even in the US. High oil prices were also, in effect, keeping Russia afloat and lessening the impact of the sanctions.

In return for swallowing his pride, he emerged from the meeting with MBS confident that oil production will increase. Or so he thought.

Earlier this month, OPEC+ (consisting of OPEC members plus other producers who are not members, such as Russia) decided to cut down oil production collectively by a whopping 2 million barrels per day. After the announcement, the price of Brent crude, the international benchmark, rose 1.7%, reaching $93.29 a barrel.

The move has come as a shock to the US and ever since, barbs have been exchanged from both sides, with Biden threatening there would be 'consequences' for Saudi Arabia, and further instructing his team to 'recalibrate' relations with the Kingdom.

The verbal spat escalated quickly. Saudi Energy Minister Prince Abdulaziz bin Salman responded to US reactions saying, "Saudi Arabia decided to be the maturer guys and let the dice fall" to which John Kirby, the communications coordinator at the US National Security Council, responded: "It's not like some high school romance here."

The Saudis have justified the move on the grounds that the global oil market is a mess and with the global economy likely heading into a recession, OPEC+ members risk being stuck with a glut of reserves if production is not reined in.

The US however sees this as a direct attempt to aid Russia in the Ukraine crisis, which is especially confounding to them, since the Kingdom is among the countries that voted in the UN General Assembly to condemn the invasion, provided financial aid to Ukraine, and most importantly, through this move find themselves in the undesirable company of Russian allies such as their archrivals Iran, who have reportedly provided Russia with drones for use in their war in Ukraine. Even more astonishingly for the US, allies such as Kuwait and Iraq also signed off on the move to decrease oil production, as did UAE, who traditionally often differ with the Saudis when it comes to decisions on oil.

What's more, it appears US officials had made last ditch attempts to convince Gulf officials to push back the move to lower production by at least a month, so that Biden could pass the hurdle of the US mid-term elections. Ever since the botched withdrawal of troops from Afghanistan, Biden has been struggling with low approval ratings, and the Republicans are slated to win back a majority in the Senate and the House of Representatives. Biden had hoped lower oil prices would help bring down at least some of the inflationary pressures on the US economy, which in return would have somewhat improved the chances of Democrat candidates going into the November elections.

Some US international relations experts have since argued that Gulf Countries could very well be more amenable to a Trump administration beyond 2024, since a Republican administration is less likely to harp on human rights conditions than a democratic one.

But can the US and the Saudi kingdom, a conjoined twin of sorts, forsake each other over this issue between their respective leaders? Though the verbal fireworks seem ominous, threatening to turn serious in the long run, both countries have no one else to turn to and serve their strategic and national interests in the foreseeable future.

Oil for arms?

Although no formal treaty or defense pact exists between the US and the Kingdom of Saudi Arabia, the former has been guaranteeing the security of the latter ever since the Kingdom came into being after World War II in return for a steady supply of oil. In fact, till the 1970s, the US were in control of the oil fields before handing it over to the Saudis, which have since made the Kingdom one of wealthiest nations on earth. For the US, such guarantees to the Kingdom and other allies of the Middle East are part of what it calls the Carter Doctrine, which aims to ensure that supply of oil remains steady.

The Saudis are further an important ally of the US to maintain regional stability, especially vis-à-vis its interests in protecting the state of Israel and countering what it sees as a growing threat from Iran. As a result of such longstanding ties, the US is by far the biggest supplier of weapons to the Saudi military – accounting for 79% of its arms and almost 100% of its high-grade advanced weaponry. In fact, since 2017, Saudi purchases of US defense technology collectively exceeded combined US transfers to allies Australia, Canada, Israel, the United Kingdom, and the countries of the European Union.

Now, the US wants to hit Saudi Arabia where it hurts. Writing for the Foreign Affairs magazine, US Senator Richard Blumenthal, a Democrat of Connecticut, called on the US to "stop enabling Saudi Arabia's bad behavior and reset this one-sided relationship."

Blumental, who introduced legislation that would pause all US arms sales to Saudi Arabia for one year, goes on to write, "Saudi Arabia needs US arms more than the United States needs Saudi oil. If Riyadh continues to take more from Washington than it gives in return, it should have to deal with the consequences."

Blumenthal goes on to argue that Saudi Arabia would be unable to replace its weapon supply from China and Russia as US weapons at that category are much more advanced, adding that the impact of halting sales on the US weapons manufacturing industry would be insignificant since sales to Saudi Arabia constitute a very small percentage of total US weapons sales.

A final decision on whether the US actually takes steps to halt weapons sales in the Kingdom is unlikely to come before the midterm elections in November. Nonetheless, a halt in weapon sales is only one of a number of threats emanating from the US establishment, which also includes talks of rotating the US F-16 fleet out of Saudi Arabia, halting continued US military assistance to the country and the US administration supporting legislation that would prevent OPEC from being shielded from US antitrust lawsuits for colluding to fix oil prices.

How bad is the OPEC+ decision?

Ever since OPEC+ decision, some experts have argued that oil producing nations are unlikely to benefit from the decision since in a depressed global economy, a rise in price would depress demand even further.

What is however inarguable is that net oil importing countries will certainly feel the pinch, as it will lead to high import costs, with an adverse effect on GDP. For countries like Sri Lanka, Pakistan and Bangladesh, already reeling under the effects of a high dollar price and consequent shortfall in foreign currency reserves, the effects could be devastating. Speaking in the parliament, Sri Lankan President Ranil Wickramasinghe said: "This is not just an issue faced by us, but several other South Asian countries. Global inflation is going to hit us all next year."

The move could also put regions like Europe in a difficult position. Many European nations have imposed a price cap on Russian oil, but Putin has said Russia will withhold exports to countries that enforce the cap. Writing for the Foreign Policy, Ellie Geranmayeh and Cinzia Bianco of the European Council on Foreign Relations, say: "Saudi Arabia is weaponizing its oil production in ways that help keep Moscow solvent and inflict greater pain across Western capitals ahead of a cold winter."

End of romance for the US and KSA?

It is patently clear that even before this crisis, relations between the US and Saudi Arabia had been navigating rough waters for a number of years. The Saudis were clearly unhappy with President Obama's nuclear pact with Iran, and the Khashoggi murder had become a thorn in the side for both parties. In fact, without the Ukraine War, it is fairly likely Biden would have continued to castigate MBS for the murder.

Nonetheless, it is too premature to assume that such long standing mutually beneficial ties can be heavily impacted by bad relations between individual leaders. After all, the US call for justice in the Khashoggi murder has more to do with MBS and less with wider relations between two countries. Likewise, if the OPEC+ decision was indeed a snub, it was a snub that had less to do with aiding Russia – especially given the Kingdom's fairly pronounced position on the invasion – and more to do with taking grief with Biden's rather public threat to Saudi Arabia's young ruler who has rather dramatically consolidated power over the last few years.

In an article titled "The long goodbye? Why America and Saudi Arabia are still inseparable", the Economist magazine argues that while both sides have come out all guns blazing, it is unlikely that relations will suffer permanent damage simply because neither side can do without the other when it comes to oil, regional stability, weapons and even trade.

It writes: "So America and the Gulf states are unhappily stuck with each other – for now. They may disagree sharply over oil prices, the war in Ukraine and many other issues. The oil-for-security bargain is no longer a solid foundation for their relationship. But no one in Washington or Riyadh seems keen to find something that is."

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel